What Warren Buffett Reads—and Why You Should Too

If there’s one person whose book recommendations are closely followed by investors, entrepreneurs, and lifelong learners alike, it’s Warren Buffett. The annual shareholder letters for Berkshire Hathaway are pored over not just for market insight, but also for books recommended by Warren Buffett and his business partner Charlie Munger.

In 2025, as news broke of Buffett’s retirement from his long-standing post, readers rushed once again to his most recent shareholder letter—expecting wisdom, perspective, and, of course, a list of books.

If you’re curious too about what the world’s most successful investor reads and want to build not just wealth, but also wisdom, you’re in the right place.

Why Warren Buffett's Reading List Is Worth Following

Buffett isn’t just the CEO of Berkshire Hathaway. He’s also called The Oracle of Omaha for a reason. With an uncanny ability to read trends, evaluate businesses, and make long-term calls, he has built one of the most formidable investing careers in history.

But Buffett credits much of his success not to instinct—but to books. Alongside his longtime partner, the late Charlie Munger, Buffett has emphasised one thing over and over: Read every day.

His annual meetings have become a pilgrimage of sorts for shareholders—and his letter is often as eagerly awaited as the event itself. Between lessons on investing and life, Buffett always slips in his reading picks.

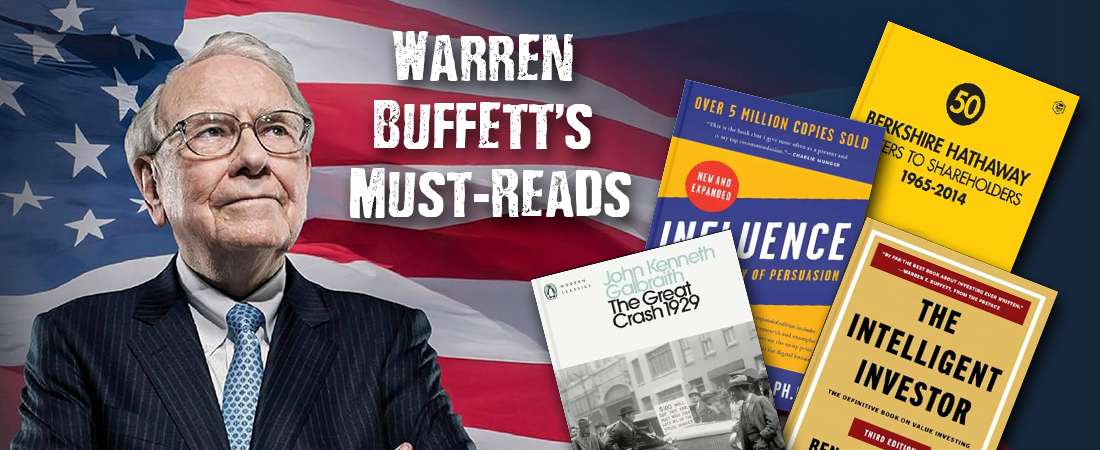

Books Recommended by Warren Buffet

Let’s break down some of the best books recommended by Warren Buffett—each offering insight into money, markets, psychology, and beyond.

This is Buffett’s all-time favourite and one he has often called “by far the best book on investing ever written.” The book introduces Graham’s philosophy of value investing—buying stocks when they’re undervalued and holding them long-term. While the content might feel dense to beginners, it’s full of timeless wisdom about risk, patience, and how not to let emotion drive your financial decisions. A must-read for anyone serious about building wealth.

This collection of essays showcases Keynes’s sharp mind and passionate belief in proactive economic policy. Written between the World Wars, the essays tackle topics like unemployment, inflation, the Treaty of Versailles, and global economic recovery. His ideas laid the foundation for modern macroeconomics, and this book remains essential for anyone interested in how economic policy can shape societies, especially in times of crisis.

A witty, offbeat glimpse into the world of Wall Street, this book compiles the legendary internal memos Alan “Ace” Greenberg wrote to his employees at Bear Stearns. The memos cover everything from work ethic to corporate culture—with firm lessons hidden between the lines. Buffett admired Greenberg’s no-nonsense approach to leadership and communication. The book’s charm lies in its mix of humour and insight, making it both an entertaining and surprisingly useful read on how to run a business with discipline and flair.

Compiled by Fortune journalist Carol Loomis, this book collects decades of Buffett-related articles and essays, including interviews and profiles that offer a behind-the-scenes look at his career. More than just a biography, it tracks how his thinking evolved and how his strategies adapted to the changing financial world. It’s both a historical document and a practical guide for business-minded readers.

This compelling biography tells the story of Robert Noyce—co-founder of Intel and one of the key inventors of the microchip. Leslie Berlin traces Noyce’s journey from small-town Iowa to Silicon Valley icon, blending innovation, business strategy, and personal charisma. It’s not just a tech biography; it’s a story about how vision, risk-taking, and leadership helped shape the digital age. The book offers a fascinating look at how one man quietly revolutionised the world through semiconductors.

This book highlights eight unconventional CEOs who outperformed their peers—not by flashy leadership but through rational capital allocation. Buffett has praised it for showing what real business performance looks like, beyond headlines. It’s a great read for anyone in leadership or trying to understand what makes a company actually successful behind the scenes.

Think of this as Buffett’s life philosophy in real time. Spanning almost 50 years, these letters track the rise of Berkshire Hathaway and reveal how Buffett responded to booms, busts, and major economic shifts. It’s candid, often humorous, and loaded with insight on investing, leadership, and long-term thinking. No better way to study his mind than through his own words.

A fascinating dive into the psychology of persuasion. Buffett and Munger have frequently pointed to Cialdini’s principles—like reciprocity, scarcity, and social proof—as crucial not just in marketing, but in business negotiation and everyday life. This book isn’t just for marketers—it’s for anyone who wants to better understand how decisions are made and influenced.

This classic traces the events leading to the infamous market crash and offers sharp lessons on speculation, economic bubbles, and public memory. Buffett values it for the historical parallels it draws—and for showing how easy it is for greed to overtake logic. A sobering reminder that history often rhymes.

by Tren Griffin

A tribute to Buffett’s right-hand man and intellectual sparring partner, this book explains Munger’s mental models and investing philosophy. While Buffett is more intuitive, Munger brought rigorous logic and multidisciplinary thinking to the table. Together, they made investing less about gut and more about reason—and this book shows how.