Timeless Stock Market Classics For Every Investor

The share market has always captured the imagination of dreamers, doers, and risk-takers. Technology may have changed the way we trade, but the principles of investing remain surprisingly timeless. That’s why, if you’re looking for the best books for share market success, you’ll often find yourself returning to the classics. The very books that shaped Warren Buffett, George Soros, Peter Lynch, and countless investors across decades.

This list of hand-picked books for share market digs into psychology, trading strategies, and the art of making (and keeping) money.

If you want Indian-specific recommendations, we’ve got you covered in this list of Indian trading books.

Why Read Books For Share Market Success?

Financial headlines change daily, but the truths of human behaviour, risk, and value don’t. The classics on this list:

- Reveal the foundations of modern investing and trading.

- Explore why we make irrational financial decisions.

- Share strategies from real market legends.

- Provide lessons as relevant today as when they were first written.

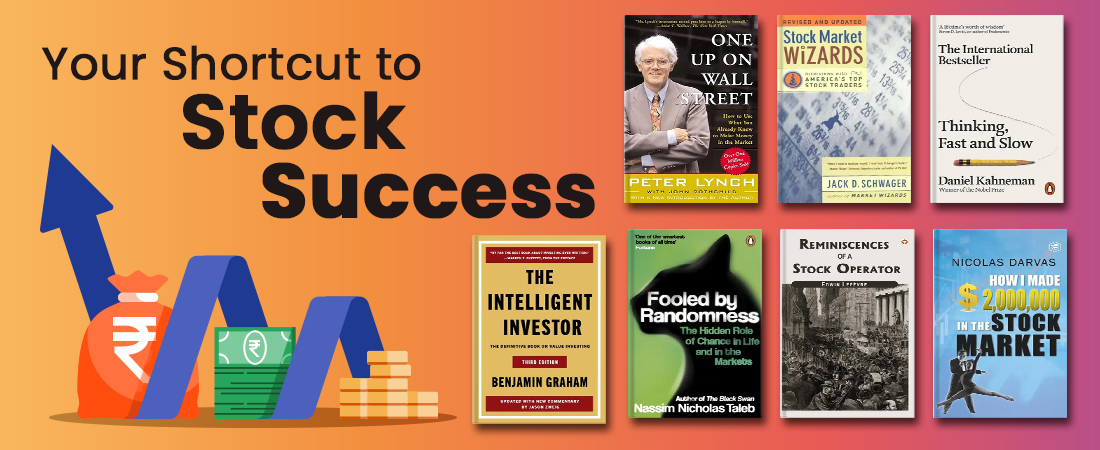

7 Best Books for Share Market Learning & Strategy

Often called the “Bible of Investing,” this book introduced the world to value investing and the famous “margin of safety.” Benjamin Graham’s approach to identifying undervalued companies shaped Warren Buffett’s entire investing philosophy.

Why it matters: If you want a rock-solid foundation for long-term investing, this is the best book for share market success to start with.

Peter Lynch, who ran the Magellan Fund at Fidelity, makes investing feel refreshingly simple. His big idea: ordinary investors can beat the pros by spotting trends in everyday life before they hit Wall Street.

Why it matters: Accessible and practical, Lynch’s book teaches you how to turn supermarket observations into investment opportunities.

What do the world’s most successful traders have in common? Schwager interviews them all – from hedge fund titans to niche traders – capturing their methods, mistakes, and mindsets.

Why it matters: Instead of one strategy, you get dozens of real-life stories proving there’s more than one way to win in the markets.

Markets are made of people, and people are predictably irrational. Nobel Prize-winning psychologist Daniel Kahneman explores two systems of thinking: fast and intuitive versus slow and logical, and how they affect decisions.

Why it matters: Essential reading for investors who want to outsmart their own biases before they outsmart the market.

Taleb’s provocative book reveals just how much luck and randomness influence success, especially in trading and finance. It’s a reminder that not every “genius” investor is more than a beneficiary of chance.

Why it matters: Builds humility and scepticism – two traits that can save you from ruin in volatile markets.

A fictionalised biography of legendary trader Jesse Livermore, this 1923 classic still reads like a page-turning novel. This classic book for share market reading captures the highs, lows, and psychological traps of speculation.

Why it matters: Beyond the drama, it’s a cautionary tale on greed, fear, and market cycles

A professional dancer turned trader, Nicolas Darvas created the famous “Darvas Box Theory”, a momentum-based method of riding winning stocks. His story is both inspirational and surprisingly practical.

Why it matters: Proof that you don’t need to start as a Wall Street insider to succeed.

FAQs on Best Book for Share Market Success

Q: Which of these books is best for beginners?

The Intelligent Investor and One Up on Wall Street are excellent starting points.

Q: Which books focus on trading psychology?

Thinking, Fast and Slow, Fooled by Randomness, and Reminiscences of a Stock Operator dive deep into mindset and behaviour.

Q: Do these classics apply to the Indian share market?

Yes. While examples come from global markets, the principles of value, risk, and psychology are universal. Pair them with Indian authors for local context.

The best books for share market success isn’t the same for everyone. Some investors thrive on Graham’s fundamentals, others resonate with Darvas’s momentum strategies, and many benefit from Kahneman’s insights into human behaviour. But together, these seven classics provide a well-rounded education, one that mixes hard strategy with soft psychology, timeless wisdom with personal anecdotes.